Facts About Guided Wealth Management Revealed

Wiki Article

Excitement About Guided Wealth Management

Table of ContentsIndicators on Guided Wealth Management You Need To KnowGuided Wealth Management Can Be Fun For EveryoneThe Ultimate Guide To Guided Wealth ManagementThe smart Trick of Guided Wealth Management That Nobody is DiscussingThe 45-Second Trick For Guided Wealth Management

Here are 4 things to consider and ask yourself when identifying whether you should touch the proficiency of a financial advisor. Your total assets is not your revenue, yet rather an amount that can aid you recognize what cash you gain, exactly how much you conserve, and where you invest cash, as well.Properties consist of financial investments and bank accounts, while obligations include credit scores card costs and home loan settlements. Obviously, a positive total assets is much better than a negative net well worth. Trying to find some instructions as you're reviewing your monetary scenario? The Consumer Financial Protection Bureau uses an online test that aids determine your economic health.

It deserves keeping in mind that you do not require to be affluent to inquire from a monetary expert. If you already have a consultant, you could require to change experts eventually in your economic life. A significant life change or decision will activate the choice to look for and work with a monetary expert.

These and various other major life occasions might prompt the demand to go to with a monetary expert concerning your financial investments, your monetary goals, and various other financial issues (best financial advisor brisbane). Allow's state your mommy left you a neat sum of money in her will.

The 9-Second Trick For Guided Wealth Management

In basic, an economic expert holds a bachelor's degree in an area like finance, bookkeeping or company management. It's additionally worth absolutely nothing that you could see an advisor on an one-time basis, or job with them more routinely.

Anybody can say they're an economic advisor, but an expert with specialist classifications is ideally the one you ought to hire. In 2021, an estimated 330,300 Americans worked as individual monetary experts, according to the united state Bureau of Labor Data (BLS). Many monetary consultants are freelance, the bureau says. Generally, there are five types of economic consultants.

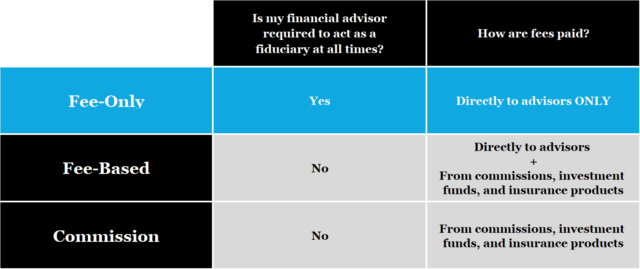

Unlike a signed up representative, is a fiduciary that have to act in a client's best interest. Depending on the value of assets being handled by a signed up financial investment expert, either the SEC or a state securities regulatory authority manages them.

All about Guided Wealth Management

As a whole, though, financial preparation professionals aren't overseen by a solitary regulatory authority. An accountant can be considered an economic coordinator; they're controlled by the state bookkeeping board where next they practice.

, along with financial investment monitoring. Riches managers normally are registered agents, meaning they're controlled by the SEC, FINRA and state protections regulators. Customers generally do not get any human-supplied monetary guidance from a robo-advisor service.

They earn money by charging a cost for each and every profession, a flat regular monthly fee or a percentage cost based on the dollar quantity of possessions being managed. Investors searching for the appropriate consultant ought to ask a number of questions, consisting of: A monetary consultant that collaborates with you will likely not be the very same as a monetary expert that collaborates with another.

7 Simple Techniques For Guided Wealth Management

This will establish what kind of professional is ideal suited to your needs. It is likewise vital to recognize any type of charges and compensations. Some advisors may take advantage of selling unneeded products, while a fiduciary is lawfully called for to select investments with the client's demands in mind. Deciding whether you need a financial consultant includes examining your monetary scenario, identifying which sort of economic advisor you need and diving right into the background of any type of economic expert you're thinking about employing.Let's say you desire to retire (super advice brisbane) in two decades or send your youngster to a personal college in ten years. To complete your goals, you might require a proficient specialist with the ideal licenses to aid make these plans a reality; this is where a monetary expert can be found in. With each other, you and your expert will cover several subjects, consisting of the amount of money you must conserve, the kinds of accounts you require, the type of insurance policy you ought to have (consisting of lasting treatment, term life, impairment, and so on), and estate and tax planning.

An Unbiased View of Guided Wealth Management

At this point, you'll likewise let your expert recognize your investment preferences. The preliminary assessment may additionally include an exam of other financial monitoring subjects, such as insurance concerns and your tax situation.Report this wiki page